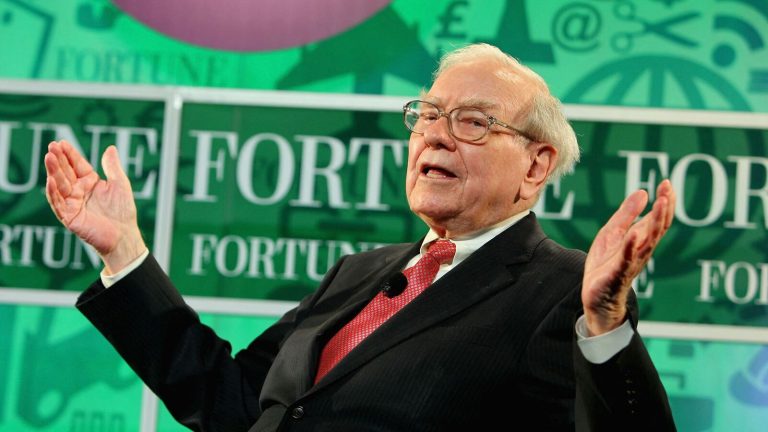

Through the years, co-founders and lifelong friends Warren Buffett and the late Charlie Munger were firm — despite the argument for it, there would be no dividends from Berkshire Hathaway.

But with a change of guard on the horizon and no clear investment plan spelt out, speculation is rife that CEO-in-waiting Greg Abel could dole out some of the company’s close to $350 billion cash reserves to shareholders.

Warren Buffett: ‘…For every dollar we keep, you’re better off…’

Notably, under Warren Buffett, who is the longest-serving CEO among S&P 500 companies, and co-founder Charlie Munger, Berkshire issued dividends only once in 1967. The billionaire investor has been quoted as saying that the decision “seems like a bad dream”.

Answering a question about their decision at the 1997 Berkshire Hathaway shareholders’ meeting, the Oracle of Omaha explained: “We don’t pay dividends because we think we can churn every dollar we retain into more than a dollar of market value.”

“If we can create more than a dollar of market value for every dollar we keep, you’re better off, whether you want to take that dollar out by selling a little piece of your stock or whether you continue to leave it in. That’s the test,” he added.

He explained that if See’s Candies was a standalone company, it would pay “very large” dividends, as the business does not allow for using money generated “intelligently, in expanding the business”. But within the overall Berkshire Hathaway scheme of things, that money is aggregate and has reasonable good prospects for intelligent use. “Dividend policy should really be determined by whether a dollar left in the business is worth more to the shareholder than a dollar paid out,” he emphasised.

Charlie Munger jokes about those paying dividends: ‘They’re Wrong’

Also speaking at the same event after Warren Buffett, Charlie Munger took a lighthearted tone to highlight that Berkshire’s decision is against the grain. “It’s interesting that you take that simple standard: You should retain money if you make it worth more than it is by (giving) it. (But), that is not the standard thing taught in the corporate finance departments of our major universities.”

“Why do we (Munger and Buffett) have this simple idea and they have another one? Time after time I’ve tried to understand why they think the way they do, and I have great difficulty with it. I’ve just concluded that they’re wrong,” he said, drawing loud laughter from the crowd.

Has Warren Buffett-Charlie Munger’s strategy paid off?

Yes, spectacularly! Over a 60-year period from 1964-2024, Berkshire Hathaway has delivered 55,02,284 per cent return on stock, in terms of per-share value, according to a Bloomberg report. If scaled on the S&P 500 stock index (with dividends included), this is 39,054 per cent or an annualised return of nearly 20 per cent — close to double that of the S&P over the same period (1964-2024).

As of 2025, Berkshire Hathaway is also the most valued company in the world, which is not a tech giant or oil producer, it added. Till 2024-end, all Berkshire companies collectively had 392,396 employees.

Its market capitalisation is $1.2 trillion — eighth-highest in global public markets. Further, the value of Warren Buffett’s Class A shares is $167 billion.

Could Greg Abel change the ‘no-dividend’ policy?

It will come down to Greg Abel’s performance as CEO. Specifically, how much returns he can give investors for the dollars he keeps, compared to if they would have been better off with a dividend.

Internally, Warren Buffett (who will remain Chairman), the board (they voted to approve Greg Abel as CEO), and various Berkshire executives across its 180 businesses have expressed confidence in Greg Abel. But Greg Abel is being keenly watched, according to Warren Buffett biography author Alice Schroeder. “Greg (Abel) is the business leader, he is not in charge of investing. That is going to be one of his and the board’s biggest challenges,” she told Bloomberg.

Speaking to the publication, Berkshire Hathaway shareholder Cole Smead added that Greg Abel “struggled” to answer questions about his capital allocation strategy during the latest AGM. “I thought, like Charlie and Warren, he would look back at a prior time in his life and tell a story about something he had experienced in investing. He didn’t,” Smead noted.

Greg Abel himself has said that he would follow the culture established by Munger-Buffett. So let’s take a look again at Warren Buffett’s own words at the 1997 shareholders meeting: “…In our own case, we’ll probably go too long before we come to the conclusion that we’re not really using it that (retaining money) effectively, because there’ll be a certain denial we’ll go through and we’ll say: ‘Well that was just temporary’. But that is our approach and we’ll do our best to apply it.”

So, for now, wait and watch it is.