Ramachandra Naidu Galla, 86, is the controlling trustee of the four family trusts, according to a recent exchange filing by the country’s second-largest manufacturer of lead-acid batteries.

“The settlement into the said family trusts is proposed to enable structured and seamless intergenerational succession of Dr. Ramachandra Naidu Galla (Promoter of ARE&M) assets, including shares/control, so as to eradicate the possibility of future conflict,” Amara Raja said filing published by the stock exchanges on 3 March.

Promoters of family-run companies are increasingly opting for the family trust model to protect their ownership while professional managers take charge of various aspects of their expanding company, taking cue from conglomerates such as the Tata group and Adani group.

The founding promoters of electrical equipment maker Havells India Ltd and real estate giant Prestige Estates Ltd also own company shares through trusts.

Also read | A charged-up Amara Raja juggles margin pressure and lithium-ion ambitions

“The creation of a trust structure where the patriarch still holds the position of controlling trustee is a way of consolidating and ringfencing the ownership of family assets,” said Sougata Ray, Thomas Schmidheiny Chair and Professor at the Indian School of Business. “The move ensures the company’s future ownership remains with the family.”

“Trusts offer protection to promoter families as individuals cannot transfer shares at their own will and have to adhere to the guidelines laid down as per the trust deed,” said Shaishavi Kadakia, partner at law firm Cyril Amarchand Mangaldas.

Kadakia also pointed out that the Securities and Exchange Board of India had granted exemptions to about 120 family-owned promoter trusts acquiring shares of listed companies from having to make an open offer to buy additional shares from the public.

The first such exemption was granted in 2005.

Also read | Mint Explainer: What sparks family feuds in Indian corporations?

Family trusts: Not a foolproof model

To be sure, a trust structure doesn’t guarantee avoidance of a future family conflict—as seen in the Kalyani, K.K. Modi, and other high-profile Indian business family disputes.

Bharat Forge Ltd chief Baba Kalyani’s dispute with his siblings over assets estimated to be worth billions of dollars took a fresh turn after a court affidavit filed two years ago surfaced some months ago.

The K.K. Modi family is currently locked in a dispute that began after the patriarch’s demise in 2019. The late K.K. Modi established a trust in 2014 to manage the inheritance of his wealth. But since his passing, the family has been locked in a dispute due to disagreements over the terms of that trust.

“Difference of opinion among family member within one trust can unravel the trust,” said Divi Dutta, partner–private client and general corporate, at law firm Khaitan & Co.

“Sometimes, promoters create multiple trusts to avoid this scenario. Moreover, beneficiaries can also unite together and direct the trustees to act in a particular manner, which may not necessarily be in the best interests of the trust… this remains a challenge for the trust model in India.”

Also read | Tata Trusts continues to oppose transfer of Tata Sons shares owned by SP Group

Amara Raja: Securing the third generation

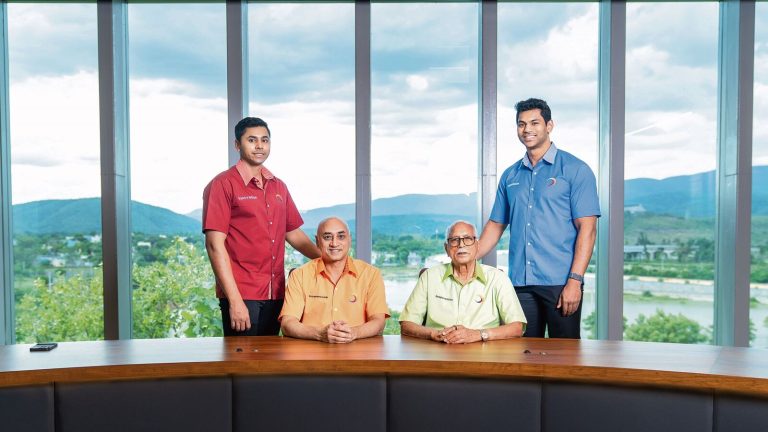

Ramachandra Naidu Galla set up Amara Raja’s first plant in Karakambadi, a town 12 km from Tirupati in Andhra Pradesh, in 1985. Six years later, in 1991, he took the company public and presided over as its chair until June 2021.

While his son Jayadev Galla took over as chairman and managing director of Amara Raja, his daughter, Ramadevi Gourineni, does not hold a position in the company. Her two sons, Harshavardhana Gourineni and Vikramadithya Gourineni, head the automotive and new energy businesses, respectively, and are part of the company’s six-member board of directors.

At the end of December, Amara Raja’s main promoter entity RNGalla Family Pvt. Ltd held a 32.9% stake in the listed company. Galla’s family members, including his wife, son and daughter, owned shares in RNGalla Family.

Galla has now transferred the promoter shares to four family trusts: 35.50% to RNG Jayadev Trust, 28.94% to Jayadev Trust, 20.68% to Ramadevi Trust, and 14.40% to RNG Ramadevi Trust, according to the exchange filing.

This trust structure allows Jayadev Galla and Ramadevi Gourineni to transfer promoter shares to their children, said a consultant working with family businesses, speaking anonymously.

Amara Raja did not reply to email queries sent on Tuesday.