The Magnificent 7 earnings are coming, and while the impact of tariffs won’t be felt in the most recent results, investors should be prepared for potential effects on guidance and capex expectations.

It is expected that big technology companies will report their most recent financial results at the end of April, with Tesla set to kick things off on April 22. This will be the first set of earnings reports since President Donald Trump implemented reciprocal tariffs on some of America’s largest trading partners.

The tariffs will have varying impacts on each of the Mag 7 companies, as no two make money in exactly the same way. Amazon.com and Apple, for example, are more likely to feel the impacts of customers pulling back if prices on consumer goods and electronics rise. On the flip side, Meta Platforms and Alphabet could get hit if advertisers pull their budgets back.

“It’s very, very difficult to suss out exactly how each specific company is going to win or lose, and the people who might have the best insight into that are the company’s managers, and for better or worse, we’re going to be hearing from them,” Steve Sosnick, chief strategist at Interactive Brokers, told Barron’s.

Regardless of what the impacts are, investors can be certain tariffs will be a major topic to listen to on conference calls with management, especially when it comes to any guidance for coming quarters, or years.

“From a technology perspective, I think we could see some earnings pressure if these tariffs remain in play for some time,” Marta Norton, chief investment strategist at Empower, told Barron’s. She added that it is notable that there hasn’t been any meaningful revisions to earnings estimates for technology yet, though.

According to Dow Jones Market Data, the consensus estimate for Tesla’s full-year earnings went to $2.69 a share from $2.70 a share on April 2, the day Trump announced his new round of tariffs. Netflix expectations went to $24.69 a share from $24.71 a share, Meta estimates went to $25.05 a share from $25.16 a share, Alphabet went to $8.90 a share from $8.92 a share, while Apple expectations went to $7.28 a share from $7.31 a share. Nvidia and Amazon’s full-year earnings estimates haven’t changed.

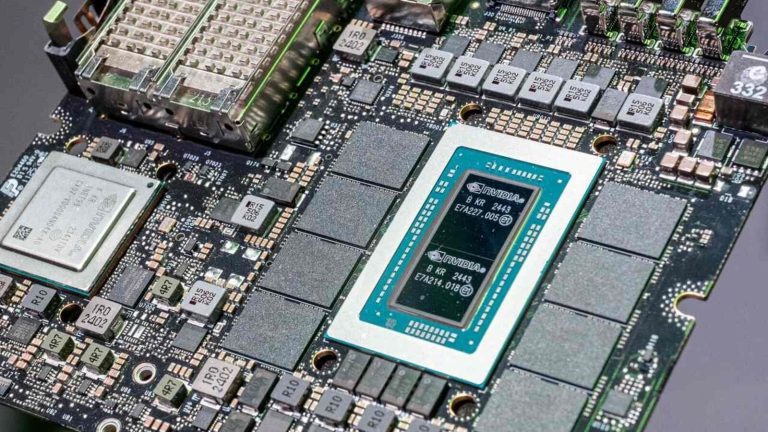

Investors will also be listening to any updates the companies share on capital expenditures. Companies like Meta, Amazon and Microsoft have committed to spending billions of dollars on building out artificial intelligence infrastructure. Wall Street will want to know if companies choose to cut back on that spending, or continue full steam ahead while costs rise and the economic environment remains uncertain.

“A lot of these management teams are going to need to focus on the long run. They’re going to not try to manage their guidance and their choices today based on how investors might react in the near term,” Norton said. “They’re going to need to do their own assessment in terms of how these tariffs impact their businesses, and make the best decisions for the long run, and that could mean volatility in the near term.”

Write to Angela Palumbo at angela.palumbo@dowjones.com