Investing in the National Pension System (NPS) is a long-term commitment, but life doesn’t always wait until retirement. What if you need funds for a medical emergency, your child’s education, or even to start a business? While NPS has a strict lock-in period, the Pension Fund Regulatory & Development Authority (PFRDA) allows partial withdrawals under specific conditions—offering a way to access some of your savings without breaking the long-term retirement plan.

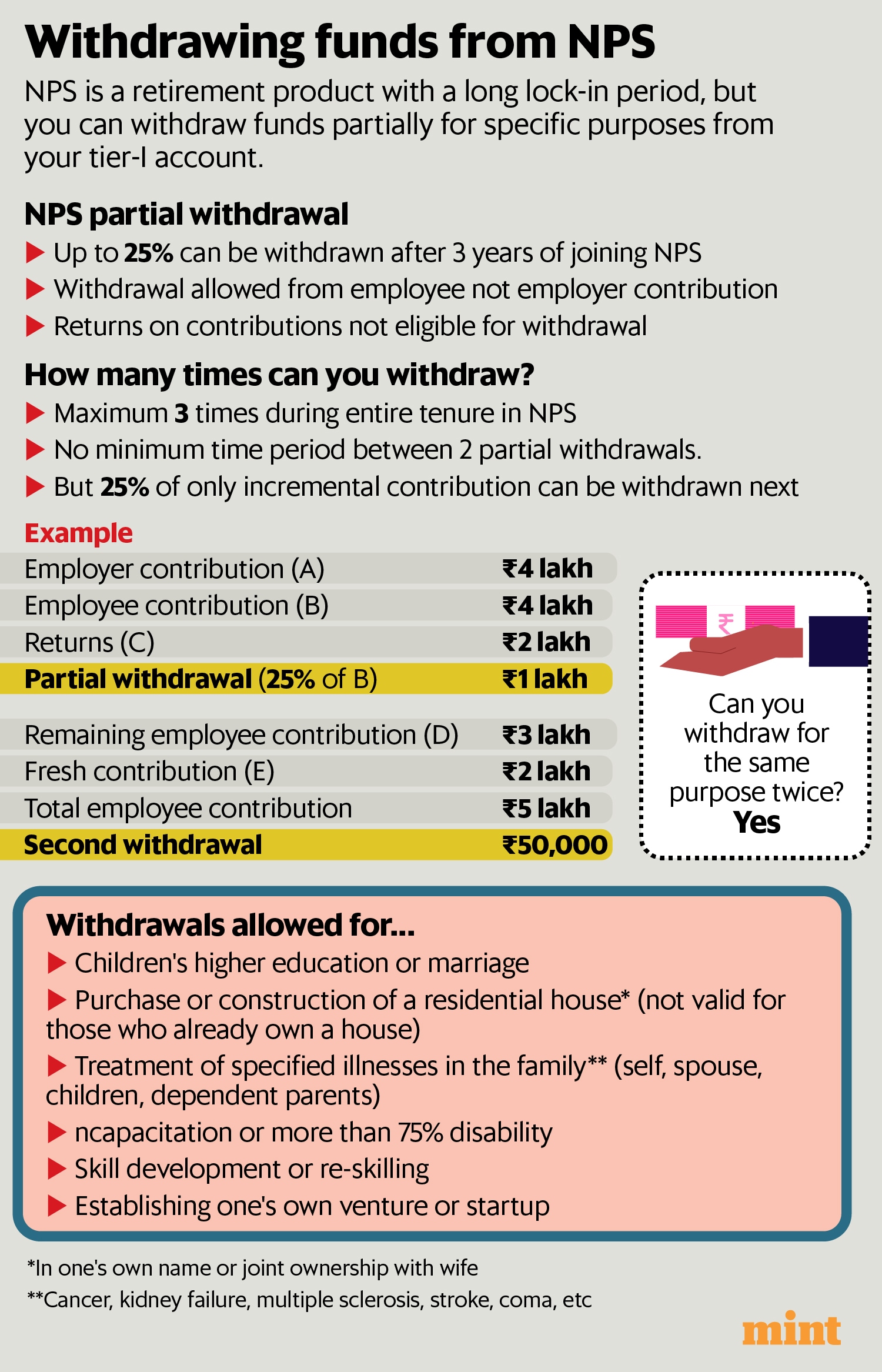

Subscribers can withdraw up to 25% of their own contributions after completing three years in the scheme. This can be done up to three times before exiting NPS. However, there’s a catch: only the principal amount contributed by the individual is eligible for withdrawal, while the employer’s contributions and investment returns remain untouched. Understanding how these withdrawals work can help you plan your finances better and avoid unexpected roadblocks.

Read this | Should you opt for both NPS and EPF in the new tax regime?

Take an example: if your personal contribution to NPS is ₹4 lakh and your employer has added the same amount, with returns on both contributions totaling ₹2 lakh, you can withdraw only 25% of your own ₹4 lakh—meaning ₹1 lakh. The employer’s share and the investment gains stay locked.

Subsequent withdrawals are calculated based on additional contributions made after the first withdrawal. If, after withdrawing ₹1 lakh, you contribute another ₹2 lakh, only 25% of that new contribution— ₹50,000—will be available for the second withdrawal.

View Full Image

When can you withdraw?

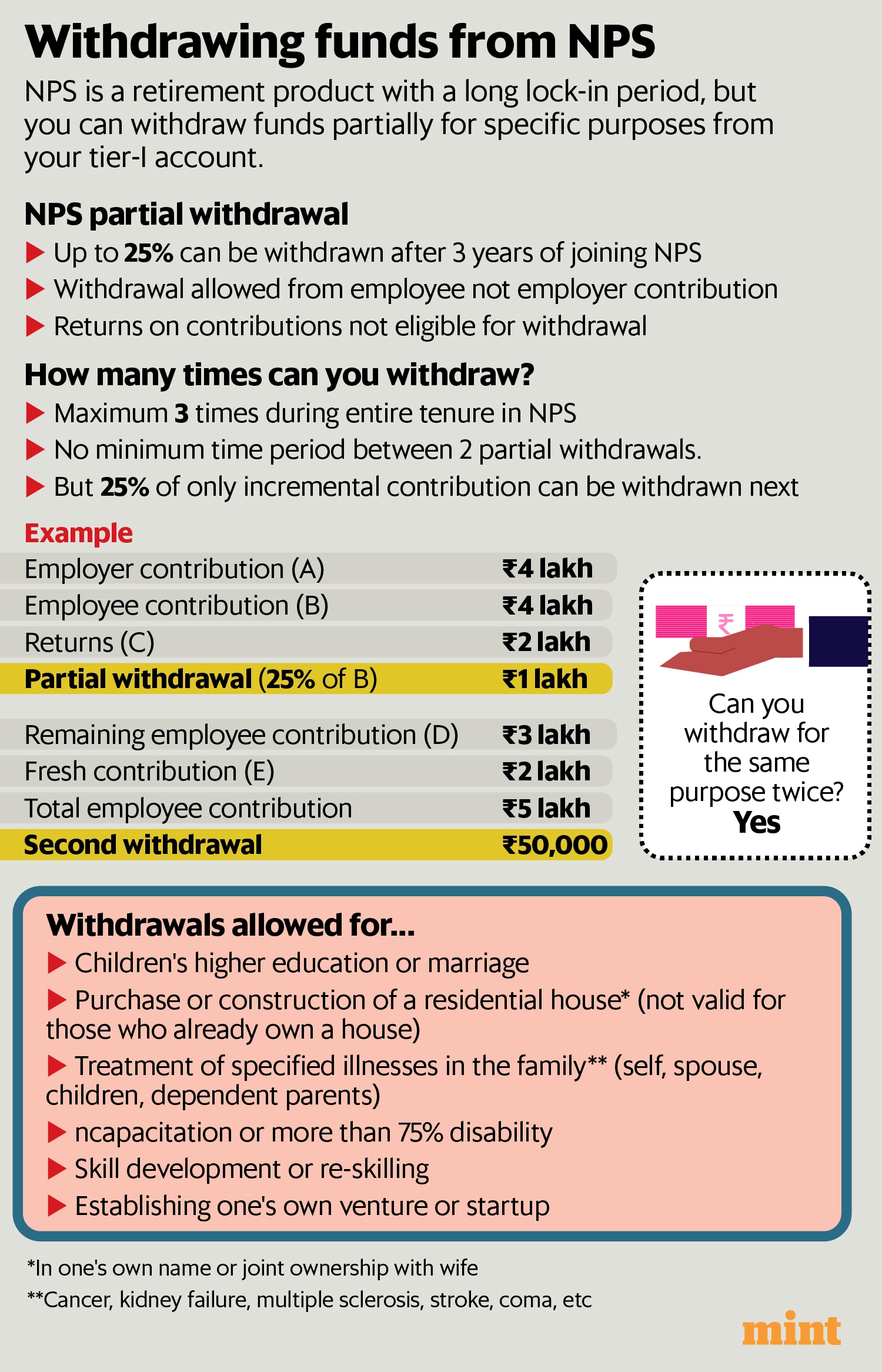

PFRDA has outlined specific reasons for which these withdrawals can be made.

These include funding a child’s higher education or marriage, purchasing or constructing a house (as long as you don’t already own one, excluding ancestral property), and covering medical expenses for critical illnesses such as cancer, kidney failure, or major surgeries.

Additionally, funds can be withdrawn to support skill development, self-improvement courses, or even to establish a business or startup. Interestingly, the same purpose can be cited for multiple withdrawals, as long as they fall within the overall limits.

For those with an NPS Tier-II account, withdrawals are even more flexible. There are no restrictions—funds can be withdrawn fully or partially at any time, making it a more liquid option for those who want the tax benefits of NPS while maintaining accessibility. However, it’s important to note that Tier-II contributions and gains do not qualify for tax benefits.

Read this | Slow and steady: How a passive approach to investing secured this Mumbai-based CEO’s retirement future

In the unfortunate event of the subscriber’s death, the entire corpus is available for withdrawal by the nominee or legal heir.

View Full Image

How to withdraw funds

The withdrawal process itself is straightforward.

Log in to your NPS account using your PRAN (Permanent Retirement Account Number) and password, navigate to the withdrawal section, and initiate a request. The system requires verification of your name and bank account details through OTP or eSign, but no supporting documents are needed—just a self-declaration stating the purpose of withdrawal.

For those preferring an offline method, PFRDA-appointed points of presence (PoPs) can facilitate the process.

What about premature exit?

If you’re considering exiting NPS before turning 60, be prepared for some restrictions.

Premature exits are allowed only after five years of membership, and even then, only 20% of the corpus can be taken as a lump sum. The remaining 80% must be used to purchase an annuity, ensuring a steady income stream. The only exception is if the total corpus is less than ₹2.5 lakh, in which case the entire amount can be withdrawn.

Also read | Why Sumit Shukla has funds tied up in NPS tier-II, not MFs

Understanding these rules can help you plan your NPS withdrawals wisely, ensuring you make the most of your retirement savings while maintaining financial flexibility for life’s major expenses.