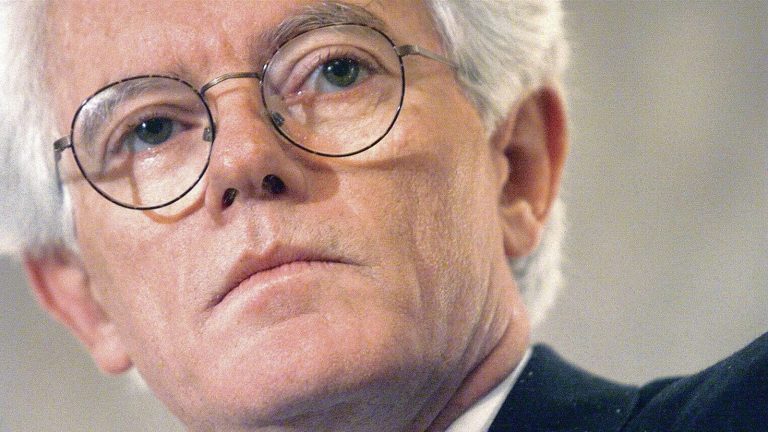

Peter Lynch’s iconic work, ‘One Up on Wall Street’, provides invaluable ideas and insights for investors aiming to navigate the challenges and complexities of the equity markets. His principles, views and investing vision, though articulated decades ago in 1989, still remain profoundly significant, for both aspirational investors and seasoned professionals.

Especially in today’s dynamic equity market landscape that is primarily dominated by absolute pandemonium caused by the aftermath of the ongoing Trump tariff saga. This write up is dedicated towards elucidating on seven key lessons discussed in Peter Lynch’s book ‘One Up on Wall Street’.

1. Invest in only what you know and understand

Lynch championed the idea that individual investors have a unique advantage. They encounter new services and products daily. Due to the same they have firsthand experience and knowledge of these products and services.

Hence, by carefully observing consumer trends and personal life experiences, investors can easily shortlist and identify promising companies before they gain wide scale attention. For example, e-commerce in India is rapidly growing.

This simple experience can provide ideas for investors to shortlist companies leading this charge. Now in this case if an investor carefully goes through the fundamentals of a business he will then invest in the same only after knowing and understanding it clearly.

This is what is professed by Lynch on much similar lines to another iconic investor Warren Buffett. The quote: “Know what you own, and know why you own it.” from the iconic book perfectly sums up this point.

2. Read, analyse and conduct deep research

Recognising a promising product, idea or business is just the beginning. Lynch emphasizes the need to delve down deep into the companies fundamentals. He believes: “Behind every stock is a company. Find out what it’s doing.”

That is why examining the total debt, financial statements, recent resignations, profit and loss data along with how competitive the company is in comparison to its peers can go a long way in helping better understand the investment idea.

This strategic approach helps in ensuring that you take informed decisions as an investor, reducing the chance of superficial decisions that are not data driven.

3. Build knowledge and have a long term vision

When you invest in the equity market’s volatility is inevitable. Lynch advised investors to primarily focus on building knowledge and having a long term vision towards portfolio construction.

You should not get carried away by short term fluctuations in the markets and stay calm. This patience allows investors to gain experience, composure and maturity and the potential to yield substantial returns.

4. Never try to time the markets

Equity markets are like life, you can never time them to perfection. Trying to do the same and hoping to achieve quick results i.e. short term gains is a myth.

Lynch clearly warns against trying to time the market advocating the thesis that wealth can only be built with consistent investments and a long term vision. That is why by sustaining a steady course, investors can navigate the ups and downs of the markets more efficiently.

5. Identify undervalued companies

To make real wealth in the markets you should train yourself in such a way that you are able to identify undervalued companies with strong fundamentals. According to Lynch: “The person that turns over the most rocks wins the game.”

Such an approach can result in significant gains. Lynch encourages looking beyond well known stocks to find hidden gems. These are stocks that are even overlooked by institutional investors. This contrarian approach towards investing can uncover numerous excellent opportunities.

6. Get a grasp over a company’s debt structure

A company’s debt to equity ratio can immensely impact its resilience and resolve especially during market corrections and economic recessions. Lynch highlights the importance of evaluating a company’s total debt obligations before thinking about investing in it, elaborating that those with manageable debt levels are better placed to handle economic challenges.

7. Learn from mistakes and errors

All investors encounter setbacks and shocks. Lynch underlines the importance of analysing missteps and errors in judgement to improve investment strategies. This process of learning and improving should be endless in nature to help you make the most of your investment journey. Embracing mistakes as stepping stones fosters growth and boosts investor confidence and future decision making.

Hence, incorporating these ideals can empower all strategic investors to make informed decisions, leveraging personal insights and diligent research to accomplish financial goals and achieve prosperity in their investing careers and life.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Please consult a certified financial advisor before making investment decisions.