Anmol Jaggi and his younger brother Puneet Jaggi pledged an additional 6.23% shares of Gensol between 1 January and 6 March, taking promoter share pledges to about 88%. The solar power plant maker’s shares have plunged 71.4% from their peak last year. This means the lenders who extended money at previous highs are left with shares that are worth far less.

“The share pledge has increased primarily on account of additional collateral given to the existing lenders due to a decline in the share price,” said a spokesperson for Gensol.

“The amount was on account of loan disbursements and payments received on the last day of the financial year. These funds were subsequently utilized/parked in FDs,” said the spokesperson, adding that this money was kept in its “existing bankers and Trust and Retention Accounts”.

According to stock exchange disclosures, falling share prices last week prompted at least one Nagpur-based stock broking firm to seize 1.47% of shares that Anmol had pledged last year. According to a review by Mint, Badjate Stock Broking Pvt. Ltd invoked share pledges made by Anmol amounting to 1.47% in seven transactions over 4 and 5 March.

Anmol pledged 1.11% with Badjate Stock Broking on 4 June last year, followed by another 0.05% pledge on 19 November. Gensol’s share traded ₹925 on 4 June and ₹760 on 19 November. On Friday, its shares closed at ₹321.20.

Also read | Jaggi-led Gensol’s debt woes much bigger than thought

“The share pledge follows the simple rule that the loan-to-value (LTV) ratio increases when share prices fall. Hence, additional shares need to be pledged when share prices fall,” said Shriram Subramanian, founder and managing director of InGovern Research Services, a Bengaluru-based proxy advisory firm.

LTV is the amount borrowed compared to the value of collateral such as shares, expressed as a percentage.

“Badjate Stock Broking has provided Loan Against Shares (LAS) and has invoked the share pledge and we are in active conversations with them,” said a spokesperson for Gensol.

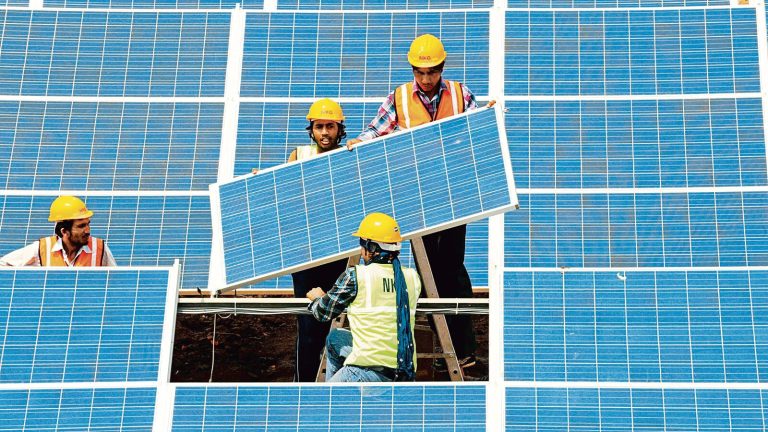

Jaggi founded Gensol in 2012 as a strategic advisory firm. By 2017, he had started a solar engineering and procurement business and took the company public in 2019. In April-December 2024, 72.3%, or ₹764 crore, of Gensol’s ₹1,056 crore revenue came from the solar EPC business. The remaining 27.7%, or ₹294 crore, came from EV leasing.

However, rising promoter share pledges are now coming to haunt the company: Promoter pledges nearly doubled to 81.70% at the end of December 2024, compared to 42.78% at the end of December 2023. Anmol, Puneet, and a promoter entity, Gensol Venture Pvt. Ltd, pledged these shares last year when Gensol’s shares traded between ₹7,20 and ₹1,075, according to an analysis by Mint.

Also read | Gensol Engineering raises ₹900 crore equity from Elara and others

Gensol’s financial crunch surfaced in public on 3 March, when Care Ratings Ltd downgraded its ₹716 crore bank loan to default, citing delays in “servicing of term loan obligations”. Icra Ltd followed the next day, stating Gensol “apparently falsified” information about its debt servicing.

Gensol has denied any wrongdoing.

However, at least one proxy advisory firm and an independent financial analyst have questioned the management’s claim of a cash crunch, since the company has previously stated that it has enough cash.

On 13 February, Jaggi and the company’s former chief financial officer, Ankit Jain, told analysts in a post-earnings interaction that the company had ₹250 crore in cash and cash equivalents. (Jain resigned last week, citing personal reasons.)

Further, Gensol’s annual report stated that it had about ₹191 crore in its current account for the year ended March 2024.

“Why would a company keep ₹190.9 crore, a high amount of cash in current accounts, especially when the money in the current account does not earn any interest,” said Nitin Mangal, a Mumbai-based analyst who runs Trudence Capital Advisors Pvt. Ltd, a Sebi-registered research firm. Gensol’s cash in current accounts jumped from ₹20.45 crore in March 2023 to ₹190.9 crore last year.

Gensol did not answer how much money was in the current accounts at the end of December 2024, saying the company “keeps its money between the current accounts and fixed deposits”.

Also read | India’s power grid facing warnings due to sudden dip in solar power generation

“All these numbers, including the claim of about ₹191 crore in current accounts last year and the company claiming to have ₹250 crore in cash and cash balances at the end of December last year, now are hard to believe. Simple because if these were true, why would Gensol default on some of its loans and claim to have a temporary challenge? So, all the numbers’ credibility is questioned, and the promoters have lost trust.”

Gensol did not respond to a query on the cash in its account.

For now, the company continues to put on a brave face.

“The promoters have sold approximately 2.37% of total equity shares of the company, amounting to 9,00,000 shares, to unlock liquidity that will be reinvested into the business through equity infusion,” Gensol said in a stock exchange filing on 7 March. “This step is part of a strategy aimed at reinforcing the company’s balance sheet and supporting stability.”

Gensol’s release last Friday stated that after the share sale, the promoters owned 59.70% of the company.

According to stock market disclosure, Jaggi and his family owned 62.65% of Gensol at the end of December 2024. After selling 2.37% of Gensol shares and an additional 1.47% now owned by Badjate Stock Broking, the promoter’s stake in Gensol totalled 58.81%.

And read | Amid US policy shifts, India turns to Africa, West Asia for solar exports