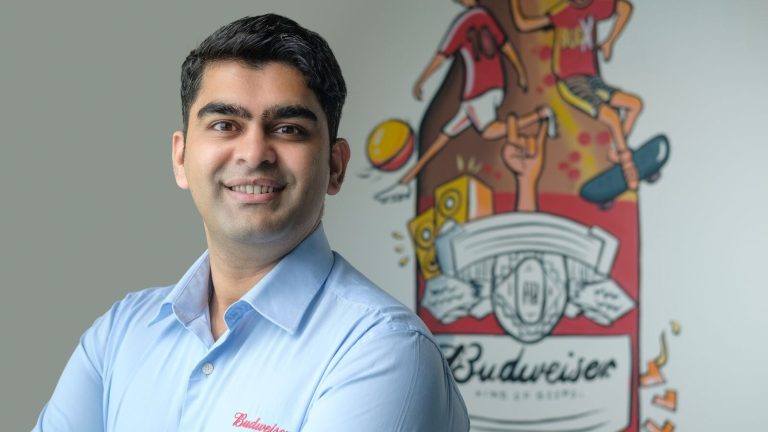

With a premium portfolio that includes Budweiser, Corona, and Hoegaarden, Belgian beer giant AB InBev is sharpening its focus on India—a market that has now become the fourth-largest globally for Budweiser. Backed by sharp digital targeting, immersive music-led experiences, and an expanding flavour-first play under Hoegaarden, the company is chasing long-term growth in a tightly-regulated category. In a conversation with Mint, Vineet Sharma, vice-president–marketing & trade marketing, AB InBev India, discusses evolving media mixes, responsible drinking campaigns, the rising role of artificial intelligence (AI), and what makes India a high-potential beer market that’s just getting started. Edited excerpts:

In a category like alcohol where direct advertising is restricted, how do you build visibility and connect with consumers?

First and foremost, we respect the law of the land—in every market we operate in. But within that framework, we’ve found powerful levers. The biggest one is the product itself—quality is our biggest advertisement. Then comes experiential marketing—both at large-scale events like Lollapalooza and in more intimate settings like bars, cafés, and point-of-sale activations. We aim to reach consumers when they’re most open to our message—during music, sports, and lifestyle moments. And digital plays a huge role too, with sharp targeting and meaningful partnerships.

We’ve been bullish on premiumization long before it became a buzzword.

Has India always been a premium-focused market for you, or is that a more recent shift?

We’ve been bullish on premiumization long before it became a buzzword. When Budweiser launched here in 2008, there was no premium beer segment. We pioneered that. Today, that segment is about 15% of India’s beer market, and growing. With rising disposable incomes, urbanisation, and aspirational lifestyles, consumers are seeking better experiences and more authentic brands. We’re seeing that across Budweiser, Corona, and Hoegaarden.

Read more: Beer brewers, after two tepid years, raise a toast to a longer, meaner summer

From a business standpoint, how important is India for AB InBev globally?

India is now the fourth-largest market for Budweiser globally—that’s a huge milestone. We’re also one of the fastest-growing markets in APAC. We don’t disclose numbers since we’re not listed in India, but I can say our investments here—across marketing, sales and trade—are increasing year on year. We’re very bullish on the India opportunity.

What does your portfolio look like right now? Any plans to bring in more brands?

Our premium and super-premium portfolio includes Budweiser, Budweiser Magnum, Corona, and the Hoegaarden range—which includes Original Witbier, Rosée and Nectarine. We also have non-alcoholic options like Budweiser 0.0 and a craft label called Seven Rivers. Some legacy brands like Haywards 5000, Knockout and Chancellor also exist in regional markets. Right now, we’re focused on scaling our current premium brands—but we’re always open to exploring new launches when the timing and consumer readiness align.

How is your media mix evolving—especially between digital and traditional formats?

Interestingly, while most brands moved from traditional to digital, our journey was the opposite. We’ve always been digital-first—it lets us target sharply, optimise spends, and reduce wastage. Programmatic buying, influencer marketing, social media—those are still our core. But as our brands have scaled, we’ve also started investing in traditional channels like TV and outdoor. Even then, the lion’s share still goes to digital and experiential.

What role do AI and martech tools play in your marketing efforts today?

Globally, AB InBev has been early to experiment—we even launched NFTs a couple of years ago. In India, we’ve begun using AI in content creation, programmatic buying, and smarter media planning. It’s still early days, but promising. With first-party data, we can now target more precisely and create relevant, real-time content. But this space evolves so fast that every year demands a fresh learning curve.

Read more: The Godfather maker makes a premium run with craft gin and single malts

What is your strategy around flavours and innovation, especially under Hoegaarden?

Hoegaarden has been a key brand for our flavour-led innovation. We’ve introduced variants like Rosée (raspberry) and Nectarine, alongside the original Witbier. These are finding traction among urban consumers looking to explore beyond lagers. Today, about 99.5% of beer in India is still lager —so there’s a huge opportunity to expand consumer palates. Flavour is one route, and we’ll continue to explore it in a calibrated way.

With music being such a strong marketing pillar for you, what’s your game plan on sports?

Music has been a big focus for over a decade—from Boiler Room and Supersonic to Lollapalooza and Corona Sunsets. But sport is definitely on our radar too. Globally, we’ve partnered with FIFA, EPL, La Liga and others. In India, we’ve mostly used those moments for advertising so far, but we’re now working on deeper fan-facing activations. You’ll see some big announcements in the sports space in the coming months.

Today’s consumer wants brands that are authentic and purposeful. It’s no longer enough to just tell a great story—you also need to live it.

Are you seeing a shift in how young Indian consumers relate to brands like Budweiser or Corona?

Absolutely. Today’s consumer wants brands that are authentic and purposeful. It’s no longer enough to just tell a great story—you also need to live it. We focus a lot on story-doing. That’s why Budweiser’s new “Yours To Take” campaign puts fans—not artistes—at the centre of the story. It celebrates the energy and anticipation that fans bring to festivals and cultural experiences. It’s fully homegrown, made in India, and rooted in how young Indians experience music and community.

Read more: Craft beer maker Bira in tax soup amid vendor payment and salary delays